Maximizing Returns: The Benefits of Consolidating Collections

The Challenge

If your institution is currently partnering with collection agencies, it’s essential to annually review your recovery process. We have found that financial institutions typically engage with around five (5) vendors to manage their collections. Unfortunately, that portfolio approach often leads to a lower return on your investment.

How much more could you collect each month with the right agency? In the case of ABC Company, it was $200,000 a month. Here is their story.

The Situation

The Situation

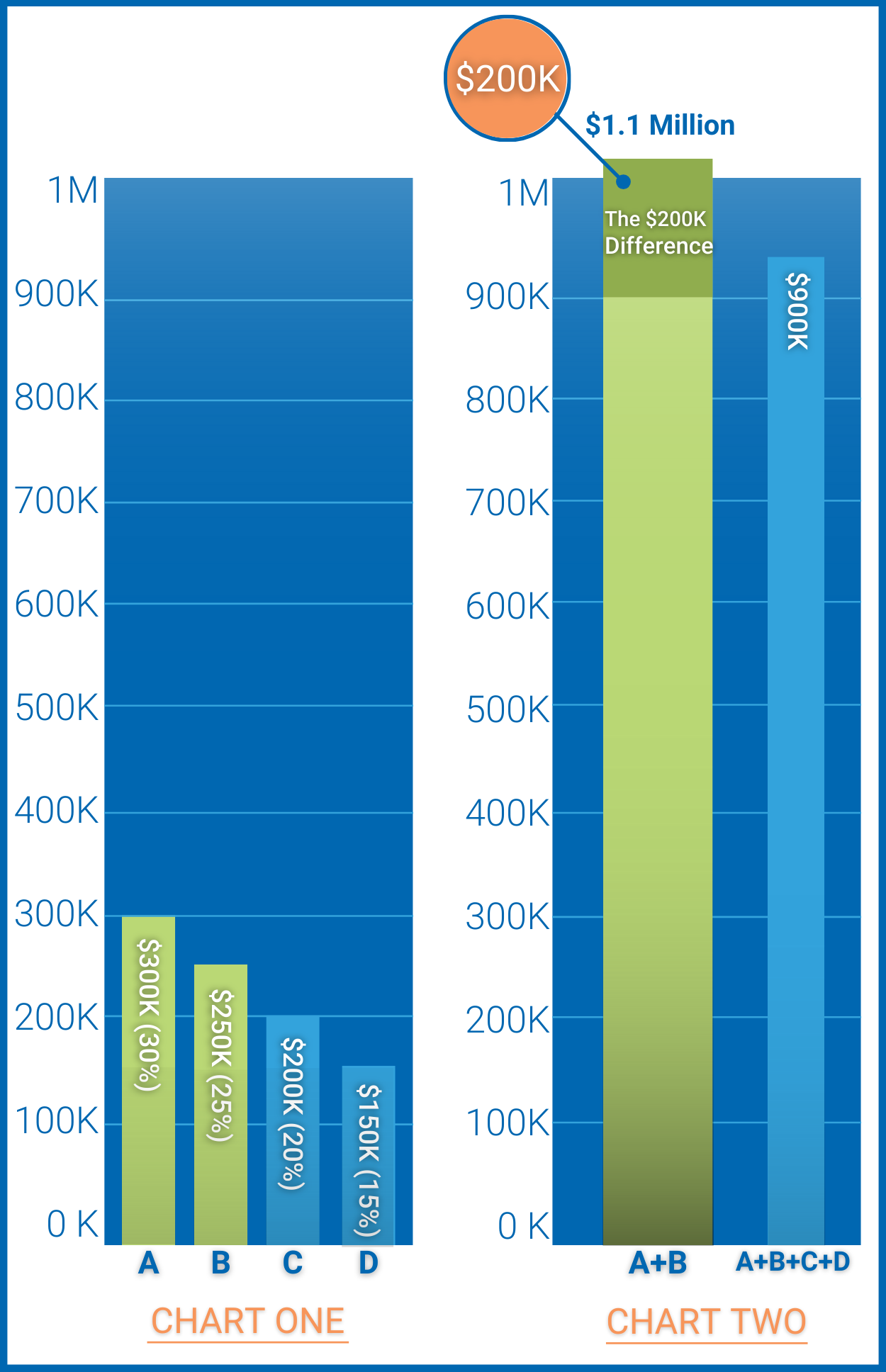

The Collection Manager at ABC Company was frustrated. They had assigned four (4) different collection agencies $1M of primary accounts each. The success of each agency varied widely (chart one). Even though a total of $900K was collected, the Manager knew it wasn’t enough. There had to be a more efficient way to improve the collection recovery rate.

The Solution

The Manager decided to reward the best performing agencies based on recovery rate. They placed $2M each to the top two (2) agencies.

The Result

The overall collection success rate increased significantly. In fact, ABC Company recovered a total of $1.1M. That’s a $200,000 difference (chart two)!

The Difference is Clear

Consolidate your collections and recover the highest percentage of dollars owed to you. Try our ROI Calculator today to see the difference yourself! At ConServe, our recovery performance is high, and our customer satisfaction levels are even higher. Learn more about how ConServe can help you optimize your returns.

Disclaimer: The above case study is a fictionalized representation inspired by real Client results. Client names and specific details have been altered or generalized to protect the privacy and confidentiality of our Clients. This case study is intended for informational and illustrative purposes only and does not represent a guarantee of similar outcomes for every Client.